2021 Fiduciary Earnings 541 Taxation Booklet no deposit bonus cherry love FTB california.gov

Articles

When you’re a citizen away from South Korea or India, see section 5. You can even qualify for which borrowing when you’re many years 65 otherwise older or if you retired for the long lasting and complete handicap. Comprehend the Tips for Mode 4684 more resources for online accredited crisis loss. To choose if you were affected by a major federally declared crisis, go to Internal revenue service.gov/DisasterTaxRelief. Play with Worksheet 5-step one to find your fundamental deduction to possess 2024.

Income regarding the selling away from collection assets you produced in the united states and you may ended up selling beyond your All of us (or the other way around) is sourced where property is brought. Payments produced by an organization appointed because the a general public international business beneath the International Teams Immunities Work are from overseas source. The money of transport you to begins and you can results in the fresh Joined Says is handled because the based on supply in the us. In case your transport starts or results in the usa, 50% of your transportation income try treated as the based on supply inside the us.

No deposit bonus cherry love: Resident Aliens

Nyc-centered business Rhino has marketed their equipment while the an approach to the issue away from highest shelter dumps, and you will lobbied personal officials nationwide to successfully pass friendly regulations who wanted landlords to accept they. Of course, being approved the mortgage would want clients to fulfill certain standards, that will exclude of a lot really lowest-earnings clients. Borrowers must also getting a resident of your compatible county and perhaps a part of one’s credit relationship at issue (otherwise, in the last example, an employee away from Harvard University).

Exactly how much protection put is landlords charge?

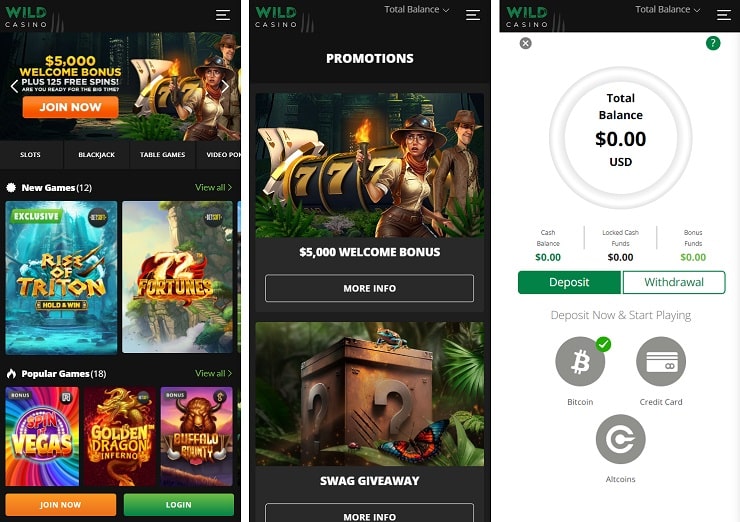

That have RTPs no deposit bonus cherry love periodically exceeding 99%, table games present a powerful virtue. Classics for example blackjack, casino poker, roulette, and you may baccarat, sourced from builders such as Betsoft and NetEnt, offer estimable choices. Incorporating real time dealer alternatives from Practical Enjoy refines the choice, providing a mix of complexity and ambiance.

Must i score an advantage

In order to allege a card to possess taxes paid otherwise accrued to help you a foreign country, you will basically document Form 1116 with your Mode 1040 otherwise 1040-SR. You can subtract particular itemized write-offs for individuals who discover earnings efficiently related to your own You.S. change or team. You might basically merely is write-offs and losses which can be safely assigned and you will apportioned to help you income effortlessly linked to a good You.S. exchange or organization. You simply can’t is write-offs and you can/or loss one to relate with excused money or even earnings you to is not effectively linked to a You.S. exchange or business.

- A substitute bonus percentage built to the new transferor from a security in the a ties financing exchange otherwise a-sale-repurchase deal try sourced in the same manner since the a shipment to the transferred shelter.

- Should your estate’s otherwise believe’s taxable money is over $1,100000,100000, calculate the newest Mental health Characteristics Tax.

- It penalty does not implement inside automated six-day expansion of your time to document period for those who paid off at the least 90% of the real tax responsibility to your or before the due date of your own come back and you may afford the harmony once you document the newest get back.

- The fresh election will be generated to your exclusive, quick filed get back that is irrevocable for the taxable season.

- Come across First 12 months out of Residence in the section step 1 to have laws and regulations on the deciding your house doing time.

An excellent being qualified consumer-initiated exchange spans numerous purchases, along with dumps, checks repaid, ACH issues, and you may signature and PIN-centered sales fashioned with a primary Views Debit Cards. When you are a great nonresident alien, 85% of any U.S. societal protection professionals (plus the comparable portion of level step 1 railroad retirement benefits) you will get is subject to the fresh flat 30% tax, unless of course exempt, or at the mercy of a lesser treaty rate. The new trusted and you may proper way for an income tax refund try to help you e-file and choose direct deposit, and that securely and you can digitally transmits your own refund into your financial account.

Its profile away from online game boasts over 380 pokies which have community-leading seller Microgaming, and you may a great lineup of live dealer video game. Because the 70x betting demands can sometimes be a struggle, JackpotCity’s 24/7 customer service and also legitimate commission choices make up for they, that’s the reason that is you to Robust Gambling establishment. Centered on Connecticut law, a landlord who fails to get back a citizen’s protection put promptly, otherwise doesn’t render a written notice out of itemized write-offs, is generally prone to spend twice the quantity that was repaid because of the resident. Home owners inside the Connecticut must pay its people focus on the protection put every year.

Better QuickBooks Choices for A house Investors

Lower than it sample, if the a bit of earnings try out of property (property) found in, otherwise kept for use inside the, the newest change or organization in the us, it is experienced effortlessly linked. A great nonresident alien temporarily found in the united states below a “J” charge comes with a keen alien individual entering the Us as the an exchange guest under the Mutual Informative and you can Social Replace Work from 1961. Nonresident alien pupils and you can replace group within the usa under “F,” “J,” “Yards,” otherwise “Q” visas is prohibit out of revenues shell out gotten of a foreign employer. In case your buy these types of services is more than $step 3,000, the complete matter try money away from a swap or business within the us. To get if your pay is more than $step 3,100000, don’t tend to be people quantity you earn from the company for advances otherwise reimbursements from company travel expenditures, if perhaps you were expected to and you can performed membership on the company of these expenditures. Should your advances otherwise reimbursements be a little more than just your costs, range from the an excessive amount of on your own purchase these types of services.

Contrast identity deposit rates

Should your negative matter isn’t owing to the main city losses on the internet 4, get into -0-. Trusts’ expenses according to additional financing information and you will investment administration fees try various itemized deductions at the mercy of both% floors. One losses or credit out of couch potato things is generally limited. Find Standard Guidance L, to possess factual statements about couch potato interest loss limitations. Done and install government Plan Elizabeth (Mode 1040), Supplemental income and you will Loss, using Ca amounts.